Tackling underinsurance exposures with reinstatement valuations

Newsletter

New Zealand is no stranger to catastrophic natural disasters, ranging from earthquakes and cyclones to tsunamis. Increasingly, we are also experiencing extreme weather events. In January, the National Institute of Water and Atmospheric research reported that “Tāmaki Makaurau Auckland received 45% of its annual rainfall, with many areas of Te Ika-a-Māui receiving over 400% of normal January rainfall”.1 Ex-tropical Cyclone Gabrielle followed in February, causing widespread flooding and damage to buildings.

With the ongoing impact of climate change likely to fuel future disasters, it’s little wonder that insurers are increasingly requesting – or mandating – updated replacement cost valuations for properties of all types.

The Opteon team is regularly engaged to provide reinstatement valuations for residential, industrial and commercial properties. This involves assessing the site by looking at factors such as floor area, quality of build and fittings, and the sophistication of the property. We then review costing databases, including our own, to determine the reinstatement costs.

According to Stats NZ in March 2023: “In the past 12 months residential construction costs increased 13 percent and non-residential costs increased 10 percent”. 2

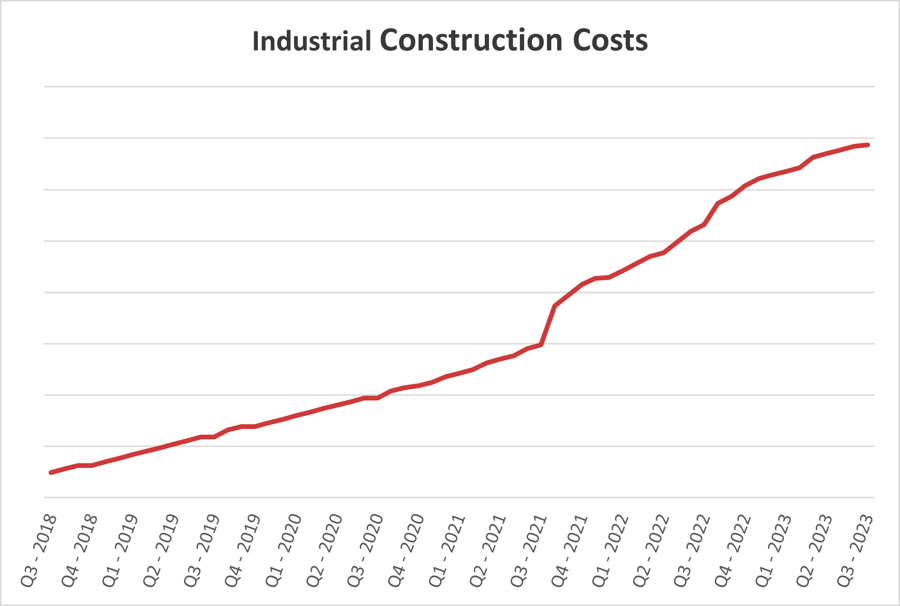

Opteon’s data shows a similar – and longer – story. In the commercial and industrial space in New Zealand, as shown in figure 1, reinstatement costs per square metre have risen drastically since September 2021. In just one year (September 2021 – September 2022) costs rose 13.8%. While there has been a further uplift of 8% year on year in 2023, the curve has started to flatten.

Figure 1: Opteon construction cost data for commercial and industrial assets

Figure 1: Opteon construction cost data for commercial and industrial assets

“It’s not news that building costs have risen sharply since the pandemic, thanks to high levels of demand and shortages of supplies and labour. However, when you look at those increased costs in the context of property insurance, failing to update a replacement cost valuation – even for just a couple of years – can leave a property owner significantly exposed in terms of the gap between costs and coverage,” said Michael Hall, Regional Director Commercial and Industrial. “For example, if a building owner kept their insurance coverage at the same level from September 2018 to September 2020 without understanding the evolving replacement costs, they would only have exposed themselves to a shortfall of 10% If that had happened between September 2020 to September 2022, the coverage shortfall would have been closer to 21%,” he explained.

Unfortunately, many homeowners remain significantly exposed to the risk posed by natural disaster events, despite the support of government insurance schemes. A 2022 Deloitte report stated: “Research shows that Aotearoa is significantly underinsured, meaning many New Zealanders are likely to have inadequate protection… Globally, Aotearoa ranks 26th out of 56 OECD countries for insurance spend, at 3% of GDP, compared to the OECD average of 9.4%.”3 The report goes on to observe that “many households and whānau will be unable to recover” if they have inadequate protection.

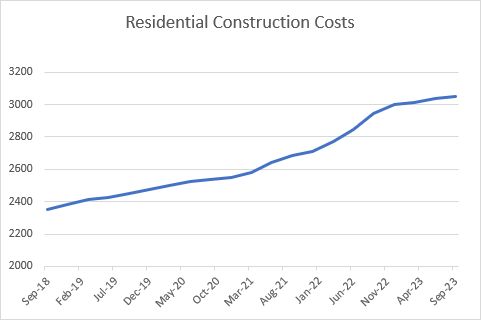

This reality of this risk is apparent when looking at the Opteon construction cost data for residential properties, as shown in figure 2.

Figure 2: Opteon construction cost data for residential properties

Figure 2: Opteon construction cost data for residential properties

As with the costs of replacing commercial and industrial assets, residential reinstatement costs per square metre have risen drastically since September 2021. Between September 2021 – September 2022 costs rose nearly 10%. In the same period the following year the curve flattened to 3.5%.

“While insurance affordability is a concern for many people, the gap between the value of a home and how much it is insured for can be a make or break issue for them if a disaster strikes,” said Richard Vaughan, Regional Director Residential. “While I appreciate it is an extra expense, understanding and addressing that gap through a reinstatement valuation can mitigate that risk.”

Michael Hall

Regional Director

+64 21 246 9474

Richard Vaughan

Richard Vaughan

Regional Director

+64 21 819 711

1https://www.building.govt.nz/about-building-performance/all-news-and-updates/facing-the-aftermath-of-the-severe-summer-weather/

2https://www.stats.govt.nz/news/building-activity-eases-in-december-2022-quarter/

3https://www2.deloitte.com/nz/en/blog/financial-services/2023/underinsurance-poses-a-threat-to-inclusive-progress-in-aotearoa.html

.png?width=393&height=259&name=Insurance%203%20(1).png)