Industrial Rental Growth Trends

Newsletter

Author

Ross Turner, General Manager - Commercial

Industrial assets have been the darlings of many institutional portfolios during the pandemic years, largely thanks to the corresponding e-commerce boom and appeal of onshoring. Now, thanks to rising interest rates and bond yields, industrial assets are experiencing expanding capitalisation rates.

In a typical market, a rise in capitalisation rates would put pressure on asset values. However, in the current market, high and growing industrial rentals are offsetting that value pressure and increasingly becoming the metric investors are looking for. ESR Australia CEO, Phil Pearce, was recently quoted by the AFR as saying: “We’re not buying long WALE assets, but properties where we can capture the rental growth and in some cases redevelop at the end of leases.”[1]

Opteon collects rental data for all commercial valuations. Since FY19, our data on warehouse rent rates has shown a solid rise in industrial rent levels – particularly in metropolitan areas.

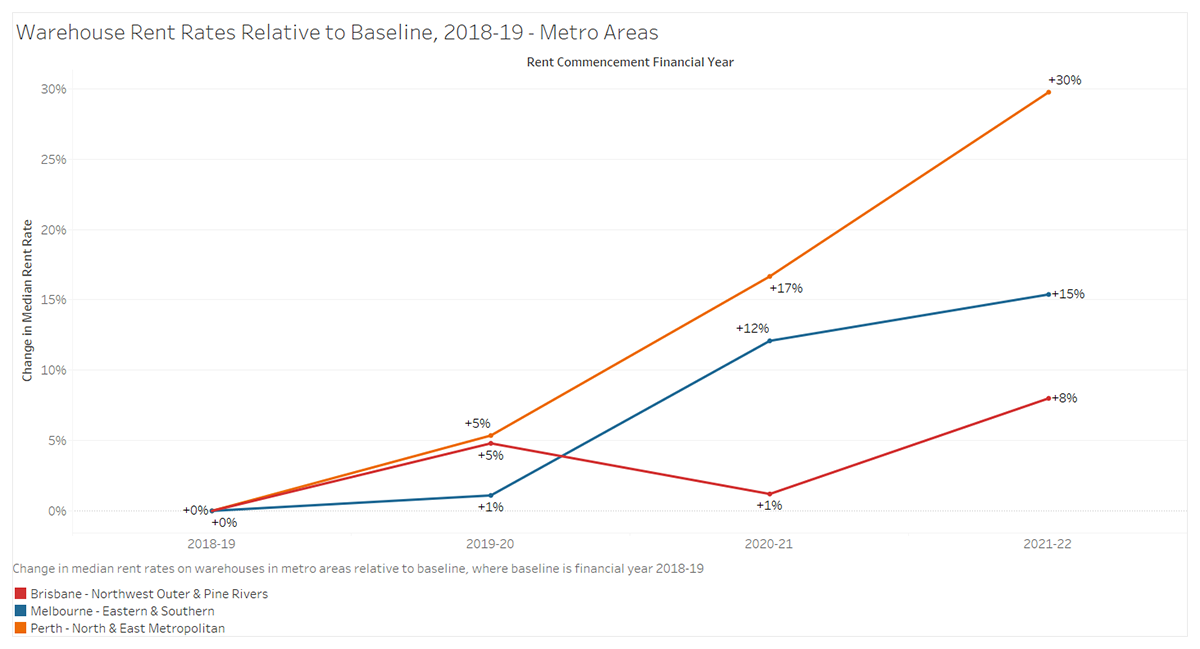

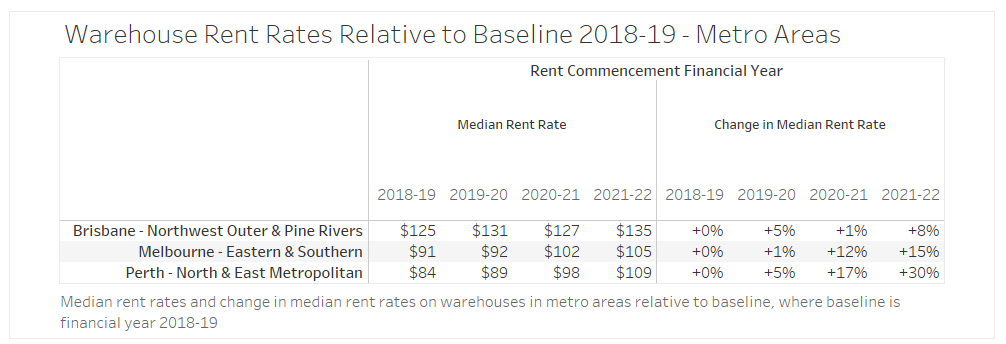

Metropolitan warehouse rental rates

Using a baseline of 2018-19 warehouse rates, as shown in the graph below which focuses on Brisbane, Melbourne and Perth, the trend of rising rental rates for warehouse assets in metropolitan locations is obvious.

However, when we examine the year-on-year changes in Brisbane, Melbourne and Perth metropolitan areas there are interesting location and annual variations, which can be seen in the following table.

The strength of growth in Perth rental rates is partly due to the increased demand of new build industrial, while rental rates are also trending higher in Brisbane overall, inconsistent transaction activity in 2020 led to the dip in our data for that year.

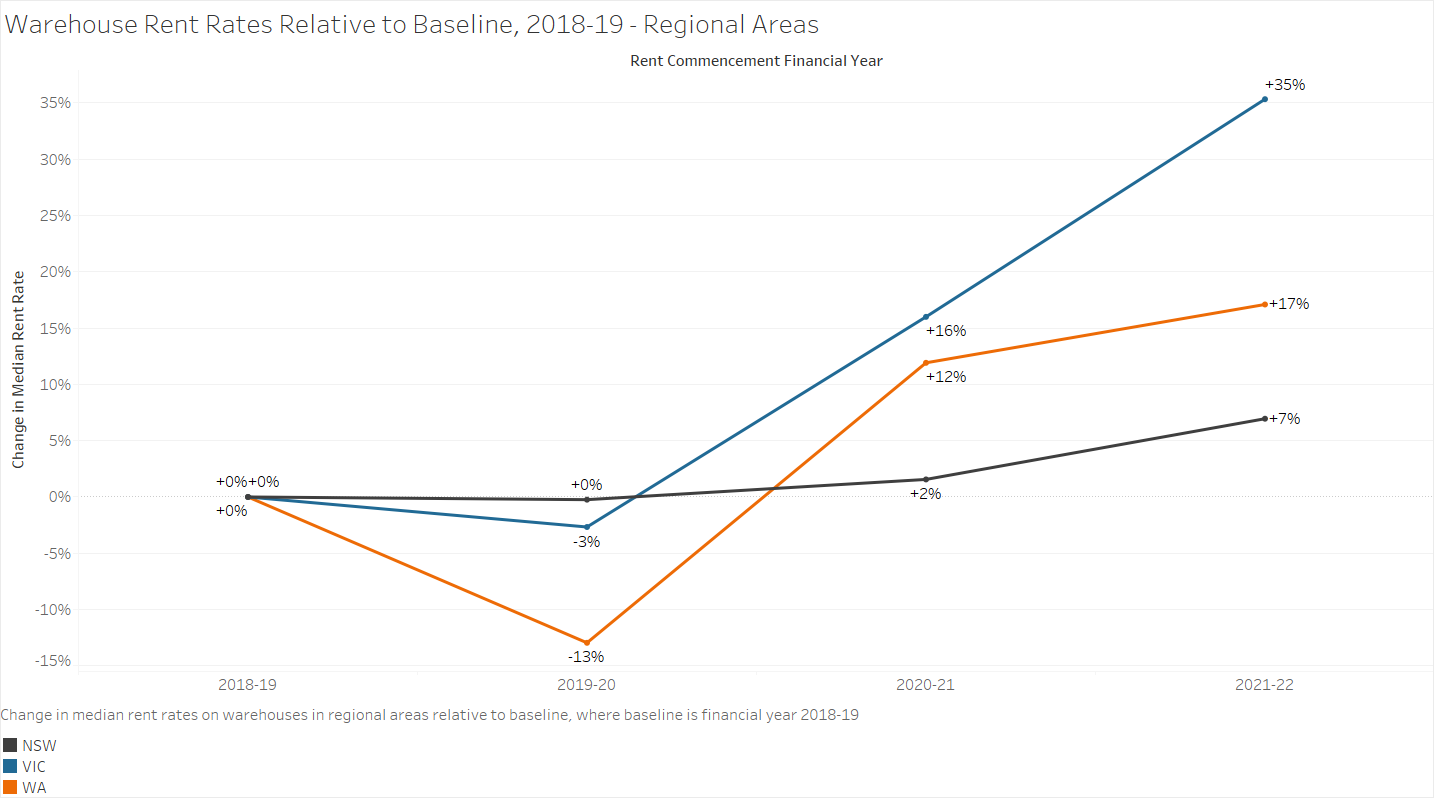

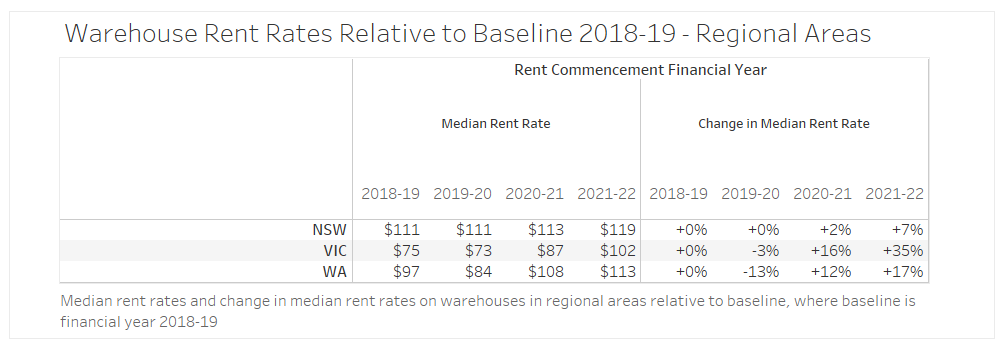

Regional warehouse rental rates

Changes in median industrial rent rates in NSW, Vic and WA, compared to our baseline of 2018-19, show rental rates for warehouse assets in regional areas also rose in most locations. However, the regional lift in rates typically lagged a year behind the trend seen in metropolitan areas.

The year-on-year changes in regional areas, as shown in the following table, indicate regional NSW has shown more subdued growth in warehouse rentals.

Top performing suburbs

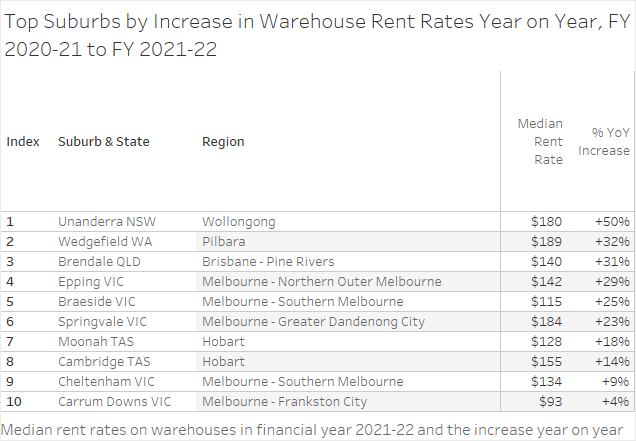

When we looked at our recent data based on year-on-year increases between FY21 and FY22, we identified the top 10 performing suburbs for industrial rent rates, as shown in the table below.

It is worth noting that that new/modern warehousing (particularly in regional locations) can skew growth metrics, as seen with Unanderra’s data in our table.

What’s next

This trend is expected to continue, with the AFR reporting in April 2022 that: “Prime industrial rents are expected to rise by an average of 11 per cent this year – more than double the rate of growth in 2021 – and to keep rising at double-digit rates over the next three years”.[2]

Ross Turner

General Manager – Commerical

DISCLAIMER

This material is produced by Opteon Property Group Pty Ltd. It is intended to provide general information in summary form on valuation related topics, current at the time of first publication. The contents do not constitute advice and should not be relied upon as such. Formal advice should be sought in particular matters. Opteon’s valuers are qualified, experienced and certified to provide market value valuations of your property. Opteon does not provide accounting, specialist tax, investment or financial advice.

Liability limited by a scheme approved under Professional Standards Legislation.

[1] https://www.afr.com/property/commercial/rental-growth-to-compensate-for-lower-industrial-values-esr-boss-20220718-p5b2d4

[2] https://www.afr.com/property/commercial/e-commerce-boom-supercharges-warehouse-rents-20220418-p5ae5c