Did You Know: SMSF’s and Property Assets

|

Blog

Did you know…

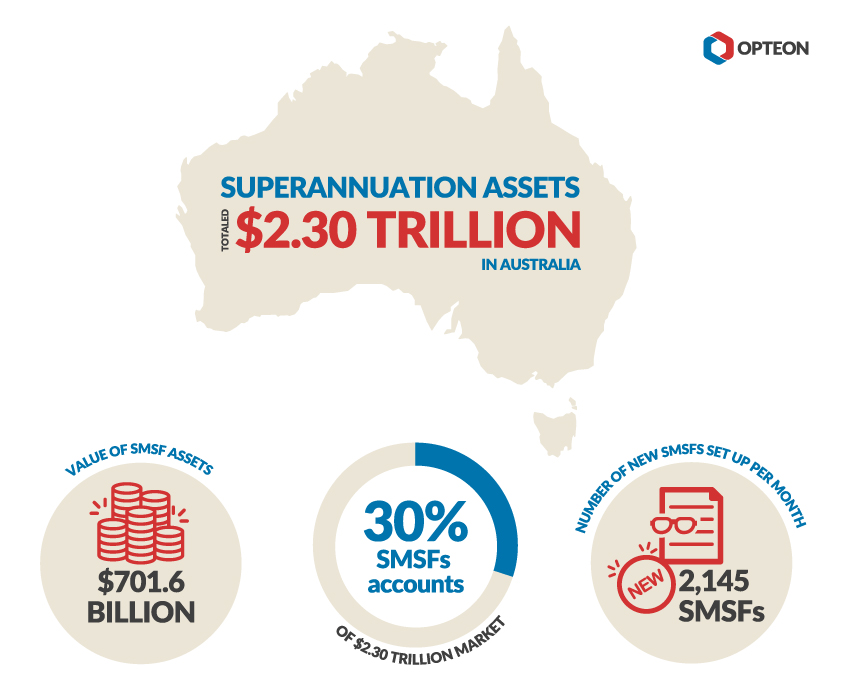

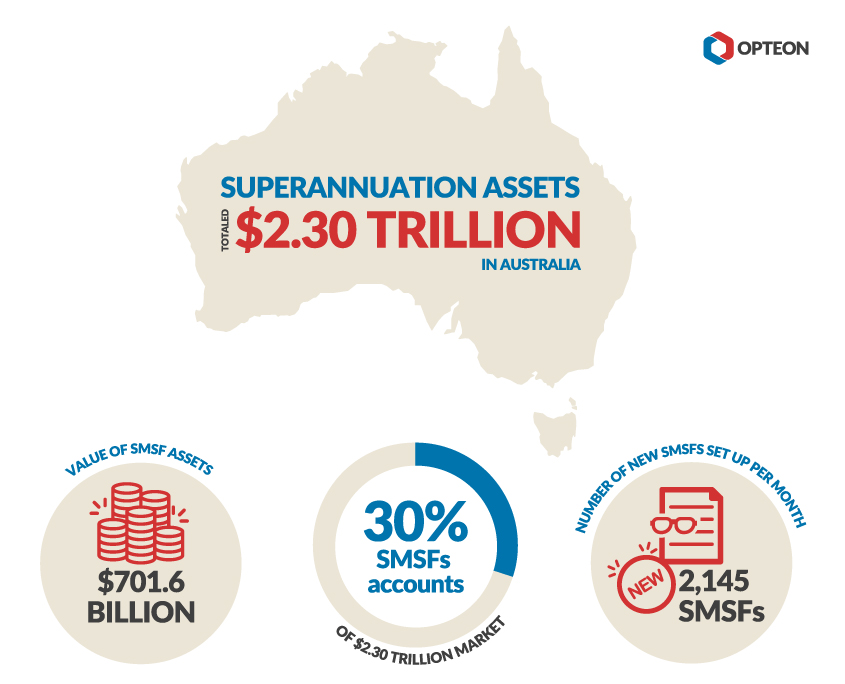

- Superannuation assets in Australia totalled $2.30 trillion at the end of the March 2017 quarter, according to APRA.

- There were a total of 590,742 Self-Managed Super Funds (SMSF) as at 31 March 2017, accounting for approximately 30% of the $2.30 trillion market.

- The difference between an SMSF and other types of super funds is that, generally, the members of an SMSF are also the trustees. This means the members of the SMSF run it for their own benefit, i.e., Self-Manage their super.

- The average total balance of an SMSF is $1,030,530.

-

An SMSF can invest in any property type or sector: for example – residential, commercial, factories, office space.

- 4% of SMSF’s have a residential property asset in them and around 11% have a commercial property in the fund.

- These property assets need regular market value assessments as part of annual financial reporting.

- Superannuation auditors will usually recommend an external valuation of any property assets in an SMSF every three years.

- If the value of a property has materially changed, or an event has occurred which could impact the value, like a shift in property market conditions or a natural disaster, or your personal circumstances have changed, you may also require an updated property valuation.

Click here for more information on Opteon’s Services for Self-Managed Super Funds (SMSF) Managers & Advisors, or call 1300 40 50 60 for a quote.

.png)