Greater Newcastle and Central Coast Commercial Property Market Update

Newsletter

Author: Karen Bates, Associate Director Commercial

Snapshots

-

We are seeing examples of strong growth in off-the-plan strata industrial sales (30% above off-the-plan prices).

-

There is strong activity from the health and allied services sector.

-

Moderate growth is being seen in commercial leasing with shorter terms preferred, due to market uncertainty.

-

Coal produced in the Hunter Valley is Australia’s largest single source of CO2[1], and there is currently little evidence to show that the property market is considering the ramifications of a decarbonized economy.

-

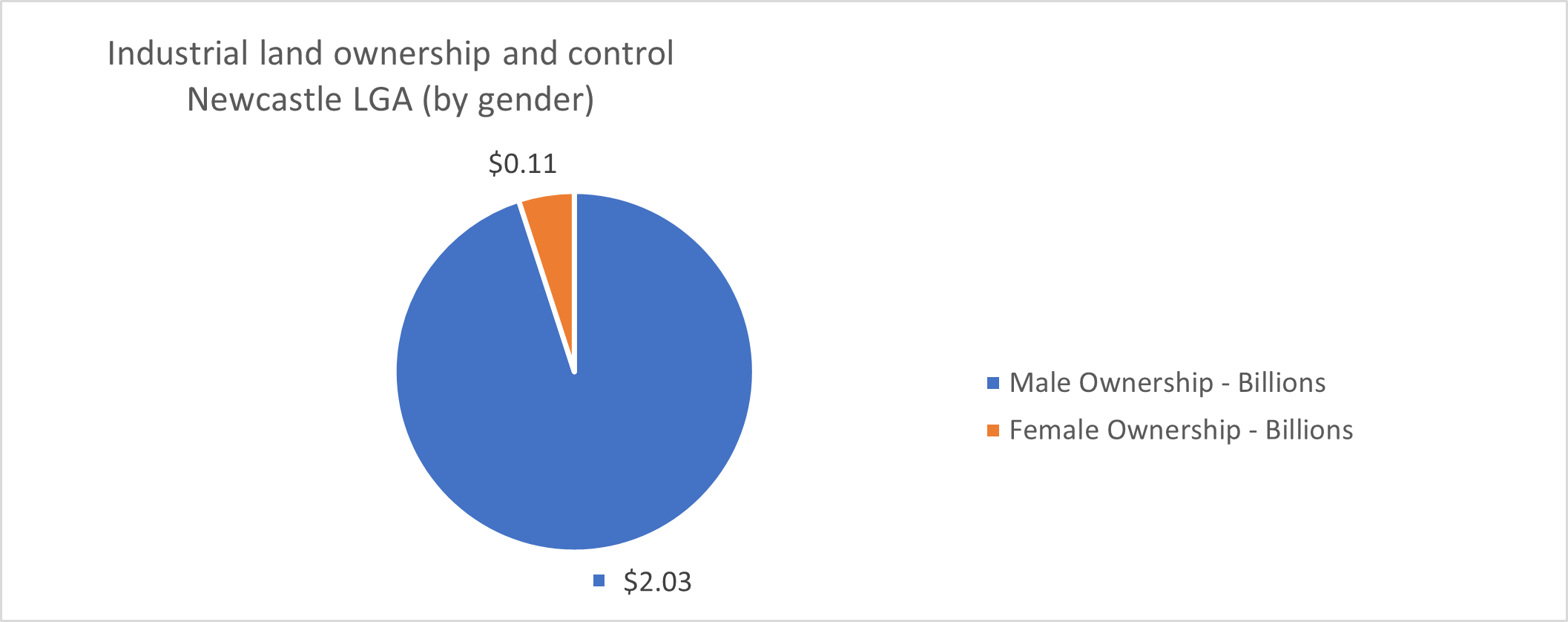

There is a significant imbalance in commercial/ industrial property ownership by gender.

Industrial market

It has been widely reported that industrial property values have been rising in NSW over the past several years. The Greater Newcastle and Central Coast regions are no exception to this, and sale prices of industrial strata units, in particular, have been increasing rapidly during 2022 and into 2023. We have seen examples of industrial unit resales reaching 30% above the ‘off-the-plan’ prices within less than a year.

A noticeable trend in industrial units across the region is the overall reduction in unit size. There are a range of new developments with strata units on offer at around 35 sqm-60 sqm, usually in gated complexes, with shared amenities in the facility. These properties are larger than self-storage units, but not large enough to operate a business from. They appear to be favored by tradespeople for storing tools and work vehicles, or personal projects such as Holden Special Vehicles that are too big for the residential shed. The preferred location for these types of units are industrial estates, close to residential suburbs, which are often the older established industrial areas. Demand for these types of developments is assisting in renewing often partly obsolete industrial areas.

We are also seeing signs of experimentation with new technology in industrial strata units, such as providing separately metered solar PV systems with remote energy use monitoring, keyless tablet entry and remote security and monitoring systems. These additions to the basic concrete shed appear to have good market appeal and are likely to continue to evolve.

Commercial market

The office and retail markets have been sluggish compared to other assets classes across the region, due mostly to the disruption of COVID-19 on businesses and workplace practices, in particular the work-from-home movement. The most notable purchasers in the commercial market have been in the health and allied services sector, including dental and radiology clinics. Many of these businesses are upgrading into new premises, often having to redevelop existing properties to suit their specific needs. This also positively contributes to the renewal of existing commercial stock.

There was very limited commercial leasing activity during 2022, as many leases were on terms negotiated during the 2020 or 2021 pandemic period. This trend turned around towards the end of 2022 and beginning of 2023, as ‘COVID’ leases are ending and business have started adjusting to the new market conditions.

Incentives still remain prevalent, particularly in regional leasing markets. There appears to have been little upward movement in commercial rents, aside from standard application of CPI or 3% increases from 2021 onwards. Agents report owners preferring shorter initial terms on new leases due to high inflation rates, as they want the flexibility to adjust rentals in line with future changes to economic conditions.

Rural property market

The Central Coast and Hunter Valley rural property market is dominated by rural lifestyle properties and hobby farms, due to their close proximity to Sydney and convenience for the ‘weekender’ lifestyle. The Central Coast Highlands is an undervalued region that is beginning to gain recognition for its prestige rural lifestyle properties.

Previously known for market gardens, citrus orchards and intensive (poultry) animal production, these land uses are now giving way to trophy rural estates, horse studs and hobby farms. There have been several sales in the past 12 to 18 months of larger-scale properties suitable for subdivision into smaller rural lifestyle blocks. One such sale reached $10 million, and was suitable for subdivision into four lots estimated to be worth $2.5 million net each.

The current interest rates affecting the residential market have also impacted the rural lifestyle market in the Hunter. A recent conversation with a sales agent active in the Hunter Valley wine tourism property market revealed the extent of the market turnaround. Last year, he had one listing and 20 people to show through. Today, he has 10 listings to show one purchaser.

Most sales agents are finding that current purchasers are wanting to wait to enter into a sales contract, thinking this strategy could get them a better deal as the market continues to slow. This hesitancy to commit has also been seen in the commercial market where agents are having to work much harder to get a sale exchanged in 2023.

Significant investment

The Greater Newcastle and Central Coast region is benefiting from a significant investment from the Cedar Mill Group, which has notably commenced construction of a 30,000-seat amphitheatre concert venue, due for completion in 2024. This is a redevelopment of the Morisset Country Club and golf course, which is strategically located mid-way between Newcastle and Sydney, with good access via the Pacific Motorway and train services.

This investment has already resulted in a significant increase in interest in the industrial and commercial precincts in Morisset, which has moved from being a secondary location to a sought-after precinct in its own right.

Coal mining

Newcastle and the Hunter are significantly affected by the coal mining industry. Newcastle is reported to be the world’s largest coal port. Most industrial estates in the region service mines and mining-related activities, and most towns heavily rely on mining for employment. Traditional residential property values in the Hunter rise and fall in sync with coal prices.

Coal produced in the Hunter Valley emits about 348 million tonnes of carbon dioxide (CO² ) each year, making it Australia’s largest single source of CO2 . There is much debate about what will unfold in this area over the next decade. The Hunter Valley Operations coal mine is currently running a campaign in the region promoting the employment and economic benefits of coal mining. At the same time, BHP and other large industry players are looking to offload their coal assets as the social license to mine comes heavily under question, and sources of investment funding continue to narrow.

At this time, the question of transition from the coal mine economy remains for the Valley. There is little evidence to show that the property market is considering the ramifications of a decarbonized economy, and most players carry on with business as usual.

From a risk perspective, the current method of calculating yield / capitalisation rates, based on the assumption of cash flows in perpetuity is an unsustainable approach. As the economy decarbonizes, which is happening at a faster rate in 2023 than anyone predicted just two or three years ago, we must recognise that ‘in perpetuity’ is no longer a realistic expectation for returns in the Hunter’s coal mine economy. Instead, we must consider either radical pivots or terminal yields.

On a personal note

Over the past 10 years as a valuer in this region, I have noted a large imbalance in the ownership and control of commercial and industrial properties, with less than 2% of my instructions being initiated by female clients.

As a small snapshot to illustrate this, the NSW Valuer General shows the total value of industrial land (excluding improvements) in the Newcastle LGA in 2022 to be about $2.13 billion dollars. If, based on my observed experience, we generously estimate that women have ownership and control of 5% of this industrial land wealth, we see the following pattern of wealth sharing:

This monetary estimate does not include the value of improvements or business and rental returns. I would very much like to see these statistics improve, and believe equitable sharing of land wealth is a goal worth working towards.

Karen Bates | AAPI CPV

Associate Director Commercial

0458 590 050

1. https://d3n8a8pro7vhmx.cloudfront.net/caha/legacy_url/53/Climate-and-Health-Alliance_Report_Layout_PRINTv2.pdf?1439938112

2. https://d3n8a8pro7vhmx.cloudfront.net/caha/legacy_url/53/Climate-and-Health-Alliance_Report_Layout_PRINTv2.pdf?1439938112

.png)