Commercial Data in Focus: Industrial Assets in Greater Melbourne

Newsletter

One of the most active segments of the market currently is metro industrial assets in Greater Melbourne. This once unloved asset class is now very attractive to owner occupiers and investors.

By Artur Giller, Commercial Property Valuer

Why the attraction?

Industrial assets offer value for money relative to space, longer-term weighted average lease expiries (WALE), and versatility for owner occupiers.

Demand for industrial assets has been on the rise across the country over the past 4-5 years, in part driven by interest rates and increased demand from high levels of online retailing and associated distribution activity.

The pandemic has further driven demand for warehousing space, particularly from owner occupiers. This reflects a surge in online sales, owner occupier need for alternative accommodation for core retail or commercial businesses, and an investor appetite for COVID-resistant ‘defensive’ assets, such as food production and cold storage facilities. Last financial year, this was reflected by very low vacancy rates, with the Sydney Morning Herald reporting a vacancy rate fall from 2.55% to 1.55% in the six months to March 2021 (source).

Investors looking for blue chip locations

Industrial land values have roughly doubled over the past 4-5 years, with the NSW market becoming particularly tight. As a result, many investors looking for blue chip locations are heading to Melbourne.

While Melbourne’s industrial market has historically lagged behind Sydney’s, we are now seeing well-leased properties (greater than 4–5 year WALEs) commanding premium investment yields below 5%. For example, Opteon recently valued a 1,647 sqm, 1990s constructed industrial facility in Dandenong South subject to a 4.5 year lease WALE with options, which sold on a 4.25% yield ($3.21m) at auction – a record sale for a secondary asset.

There has also been ongoing strong demand for industrial assets from owner occupiers across Greater Melbourne. This trend is expected to continue for some time, with owner occupiers continuing to vie strongly for assets offered with vacant possession or those with a short-term lease expiry.

Warehouse shells with good clearance heights are proving particularly popular as they offer versatility of use, from storage or workshop spaces, through to distribution and food processing facilities and office conversions.

New vs existing assets

While industrial assets in Melbourne’s industrial precincts are being hotly contested, new industrial estates with wide streets, new buildings and better linkages to arterial roads are commanding a premium compared to existing established estates. For example, Campbellfield land rates typically attract $500-$600/sqm and similar sized lots in Epping, immediately north of Campbellfield, are attracting land rates of $600-$700/sqm.

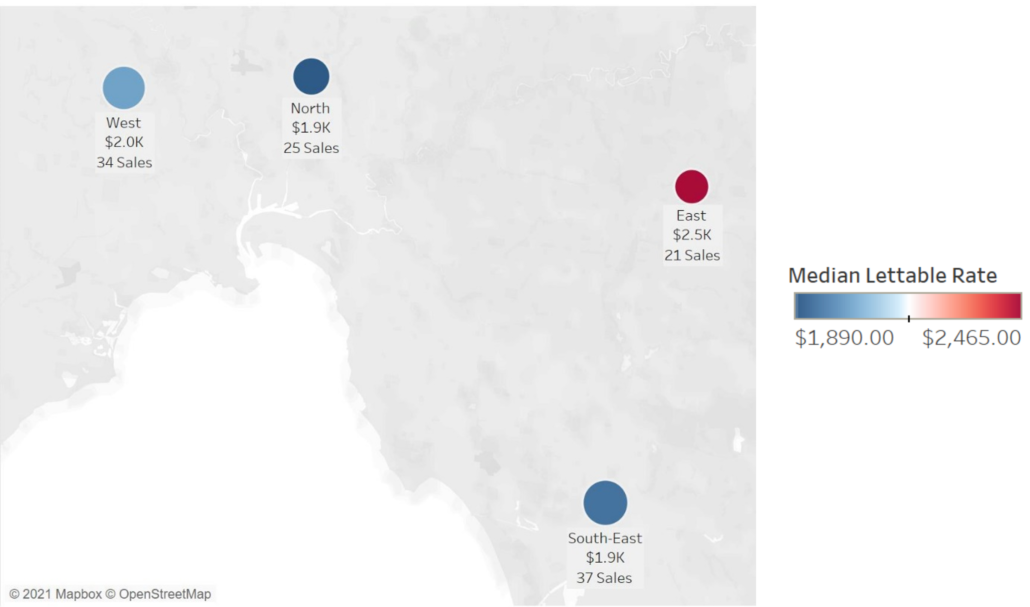

The following map shows Opteon data for Q1 2021 sales grouped by industrial precinct and median lettable rates. With no sales recorded in the inner city, the map shows the highest lettable rates are found in the east.

Map showing Opteon data for Q1 2021 sales grouped by N Area and median lettable rates

Map showing Opteon data for Q1 2021 sales grouped by N Area and median lettable rates

What the numbers say

While institutional investors are leading way with headline-grabbing warehouse purchases, such as the $61m deal for new facilities in Braeside made by ASX-listed IVE Group in June 2021 (source), the <$10m industrial market in Melbourne is also performing strongly.

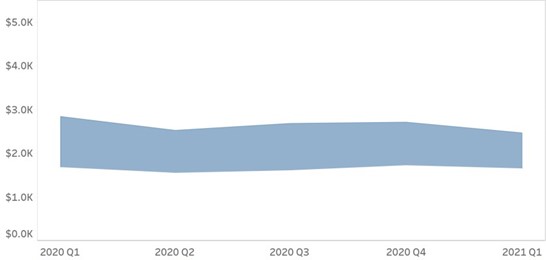

In Victoria, the interquartile range (IQR) of lettable rates for <$10m industrial assets has been quite stable since the start of 2020.

Lettable rate ranges (metro and non-metro areas)

Notably, Victoria’s IQR of lettable rates was less than half that of NSW.

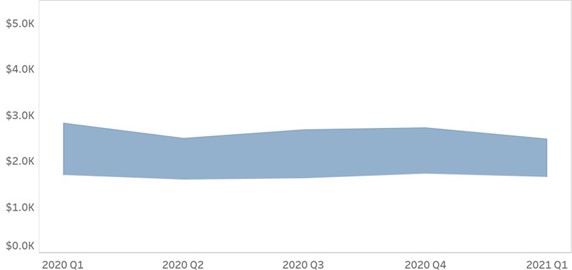

In Q1 2021, lettable rate ranges for 50% of sales ($0.9k IQR) were between $1.6k and $2.5k in both the state (shown above) and in metro areas (shown below).

Lettable rate ranges Melbourne

The median lettable rate for Greater Melbourne industrial property has been stable since the start of 2020, as shown in the graph below.

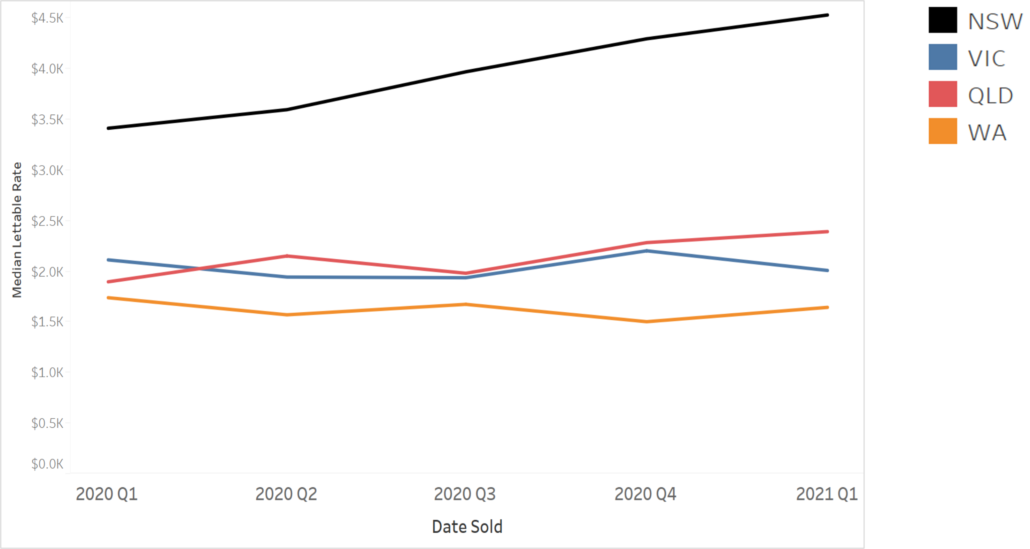

Median lettable rates – metro warehouses by state

Median lettable rates – metro warehouses by state

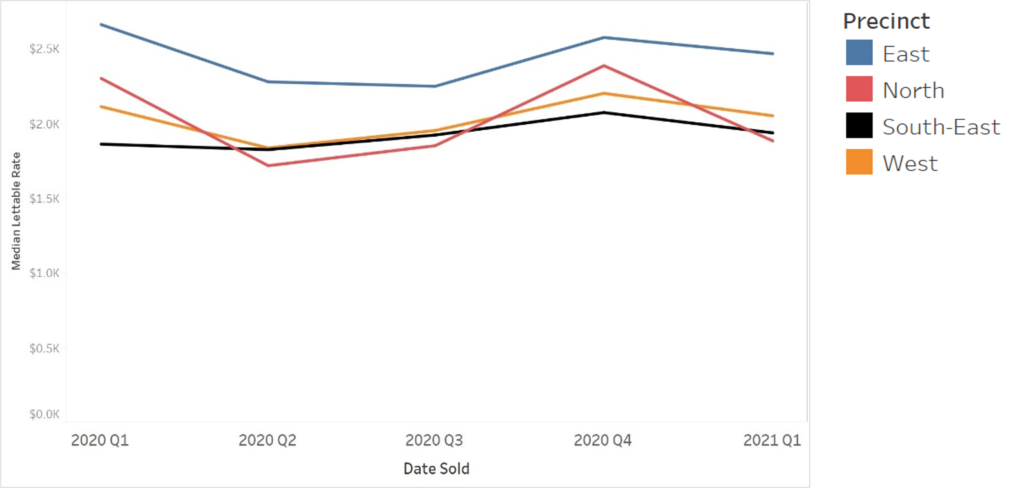

Median lettable rates were $200-$500 higher in the east than in other parts of Melbourne throughout 2020 and into 2021, as shown in the graph below. Rates dropped in all areas except the south-east in Q2 and Q3 2020 (likely reflecting Melbourne’s lockdowns) and picked up again in Q4 2020.

Median lettable rates – metro warehouses by area

Median lettable rates – metro warehouses by area

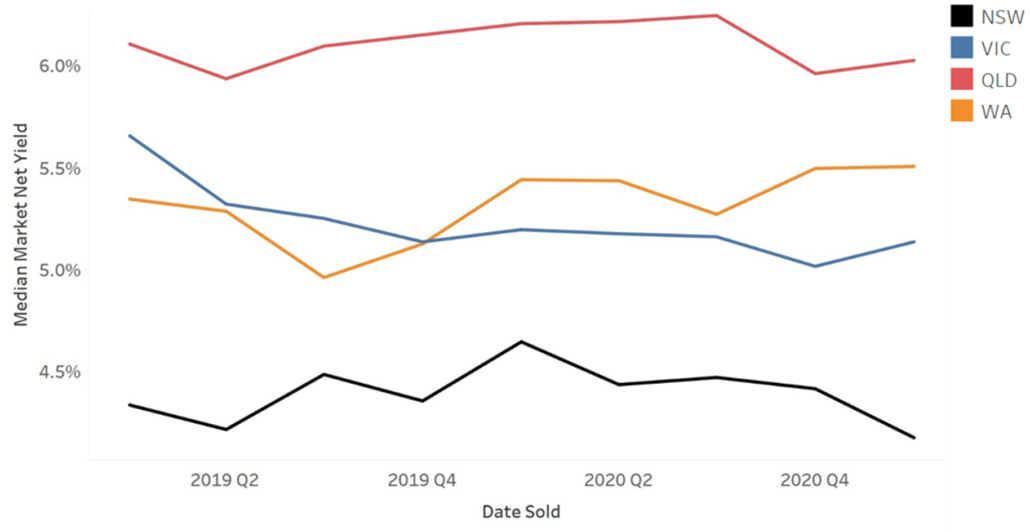

Median net yields for <$10m industrial property assets in Melbourne have been dropping since early 2019, from 5.7% in Q1 2019 to 5.0% in Q4 2020, as shown in the graph below.

Median market net yields – metro industrial property by state

Median market net yields – metro industrial property by state

What’s next

As new records and milestones are set, they become the benchmark for next property that goes to market. This trend may see a situation where Greater Melbourne industrial property net yields, which have compressed from approximately 7% to mid-4% in recent years, further tighten and building rates increase.

We also expect to see ongoing interest in Melbourne’s industrial market from interstate buyers, particularly those from Sydney, who seek higher investment yields compared with the high 3s – low 4s seen in Sydney’s market.

DISCLAIMER

This material is produced by Opteon Property Group Pty Ltd. It is intended to provide general information in summary form on valuation related topics, current at the time of first publication. The contents do not constitute advice and should not be relied upon as such. Formal advice should be sought in particular matters. Opteon’s valuers are qualified, experienced and certified to provide market value valuations of your property. Opteon does not provide accounting, specialist tax or financial advice.

Liability limited by a scheme approved under Professional Standards Legislation.