Opteon’s new Core Commercial Report speeds up valuations

Newsletter

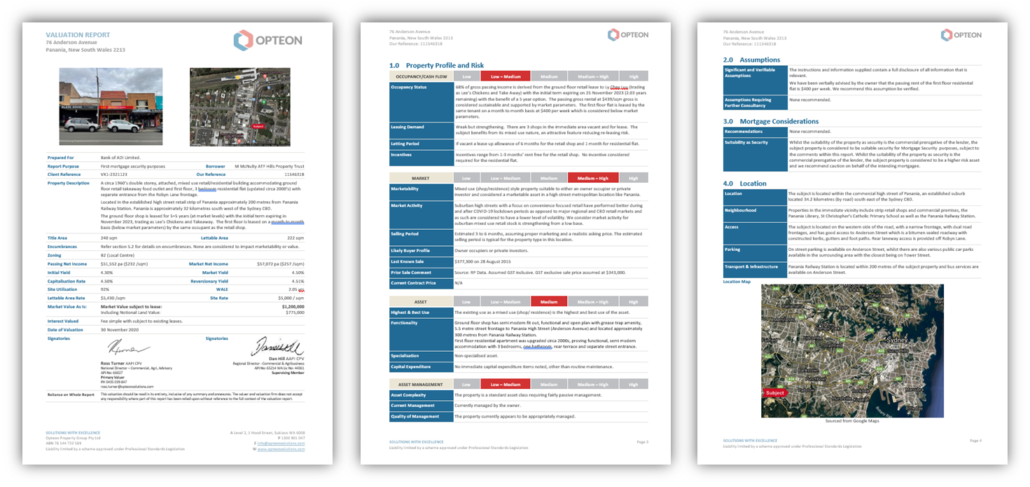

In response to market demand for accurate, fast and easy to understand valuations across the sub $5m property asset classes, Opteon has invested in a new Core Commercial Report. The tech-enabled report provides banks with a succinct summary of the key risks and metrics up-front – in about half the time taken by many other valuation providers.

By Ross Turner, National Director Commercial Agri Advisory

Turner said: “With a shortage of valuers in the market, turnaround times across all asset classes is often blowing out to more than 20 days in regional areas. We know how frustrating that is for our clients, so we’ve invested in a solution that lets us deliver a quality valuation report in five days.”

The technology enabled report features:

- a concise summary of valuation metrics

- enhanced risk assessment

- consistent reporting across all geographies

- logical flow of information

- simple, straightforward report

- succinct, data-informed market commentary, and

- same high-quality data with less duplication of information.

Opteon's Commercial Report provides banks with a succinct summary of the key risks and metrics up-front

Opteon's Commercial Report provides banks with a succinct summary of the key risks and metrics up-front

Opteon has been using the Core Commercial Report since May with great results. Early indications show the report has:

- reduced turnaround times in metropolitan areas with high volume markets to approximately five days

- reduced turnaround times in regional areas

- provided the right level of quality, specific information to inform credit proposal reports

- improved content quality and format, reflected by a reduction in post-valuation enquiries of 4%, and

- increased average efficiency in report preparation by 20% - 30%.

The 24-page Core Commercial Report, illustrated with photographs and maps, includes:

- a cover summary page featuring the key information financiers need, spanning a brief property description, key property and investment metrics, and market value

- a property profile and risk assessment addressing occupancy, market, asset and asset management factors

- brief summaries of relevant assumptions, mortgage considerations and location detail

- a tenure assessment, which includes easements, encumbrances and other interests

- a planning summary, including relevant council planning and zoning information, existing and permitted uses, and any heritage issues

- summaries of site and building area details

- an assessment of construction, building and other improvements made to the property, as well as a condition report and repair recommendations

- a summary of environmental issues, including contamination and asbestos, and a completed contamination questionnaire

- an overview of income details, including a lease summary, statutory assessments, outgoings, and a passing income summary

- succinct, data-informed market commentary, rent and sales evidence (including a sample of comparative property snapshots), and market comparisons for lettable areas and yield

- a SWOT analysis

- an estimate for insurance value, and

- a summary of the valuation method, scope of report and our conclusions.

Case study: Retail property in Mornington, Victoria

The challenge

One of the Big 4 banks faced a valuation challenge at the end of the financial year. It had a customer that had entered into a contract for an investment retail property in Mornington, Victoria and was unable to source a valuation report from any of its valuation panel members in under 20 days.

The solution

As the investor wanted to secure approval before the end of the financial year, the bank called Opteon. One of our valuers was able to inspect the tenanted property quickly and produce a 24-page Core Commercial Valuation report within five days.

The result

The Opteon Core Commercial Report clearly highlighted the key property, financial and risk information up-front, enabling the bank to make a swift, informed credit decision.

The bank and its customer were very pleased with the service and the quality of the report, particularly as speed to approval was critical for the investor.

DISCLAIMER

This material is produced by Opteon Property Group Pty Ltd. It is intended to provide general information in summary form on valuation related topics, current at the time of first publication. The contents do not constitute advice and should not be relied upon as such. Formal advice should be sought in particular matters. Opteon’s valuers are qualified, experienced and certified to provide market value valuations of your property. Opteon does not provide accounting, specialist tax or financial advice.

Liability limited by a scheme approved under Professional Standards Legislation.

.jpg)

.png)