Mortgage Report Data Reveals Flood Risks across Australia

.png)

Author

Scott O'Dell - General Manager - Residential

It’s not news that Australia has experienced many major flood events over the past two years, particularly along the east coast.

Historically, property values have proved resilient after significant flood events. For example, as reported in the AFR1: “A year after the Lismore floods in 2017, house prices rose 11.5 per cent. Similarly, after floods in the same area in 2020, median house prices surged a record high of 25 per cent from 2020 to 2021.”

Opteon data on property in high risk and medium-high flood risk areas over the past five years supports this trend. In fact, in some areas, high risk properties were worth more than lower risk ones. The value resilience of these properties has been helped by low interest rates, low turnover rates and strong median price growth that has been fueled by the rise of lifestyle factors in purchasing decisions.

However, with 100-year flooding events now occurring with frightening regularity, interest rates rising, a flattening market and housing buyback schemes being discussed for flood-prone lands, it is critical valuers closely monitor flood risks in prone local government areas (LGAs) and remaining vigilant to market sentiment and movements.

Opteon considers environmental issues, including flood risk, in all mortgage reports. We rate properties as being at a high risk of flood where one-in-20 year flood events are predicted to affect a building on the property. We assess properties as being at a medium-high risk of flood where one-in-20 year flood events are predicted to inundate the land but not affect buildings.

Flood Risk Across Australia

High risk

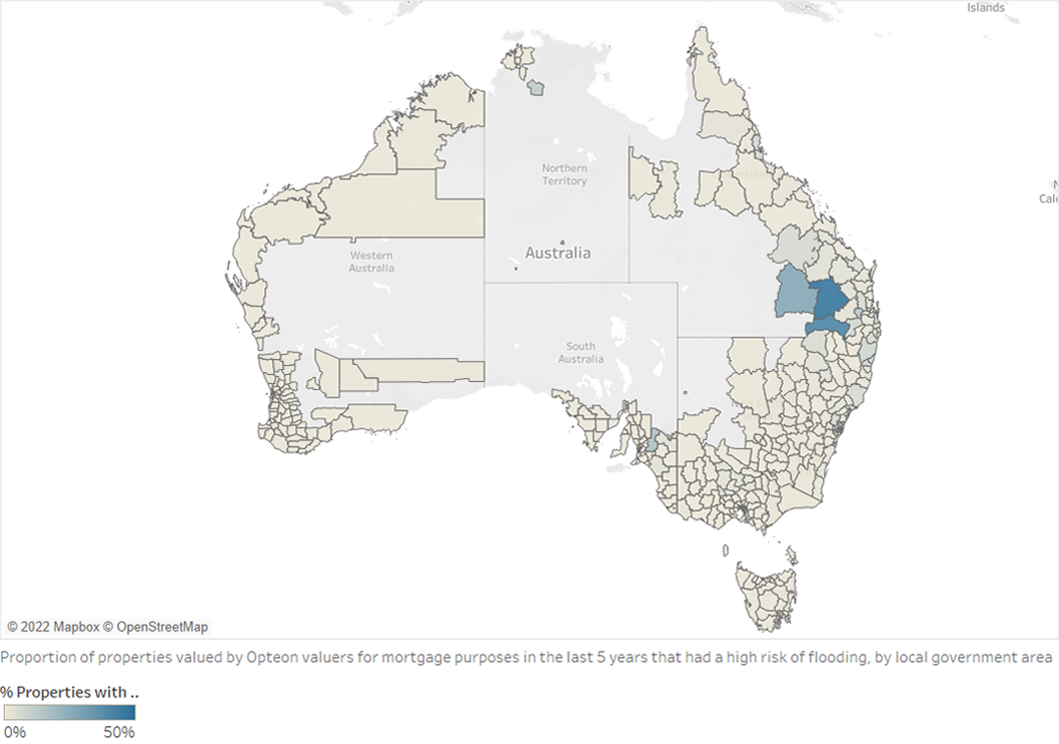

Over the past five years, 1% of all properties Opteon valued for a mortgage report had a high risk of flooding. These are shown by LGA in the map below, with areas with fewer than 50 high risk properties excluded. There was a notable cluster of high-risk areas in southern Queensland.

Properties with High Risk of Flooding by Local Government Area - Map

Medium-high risk

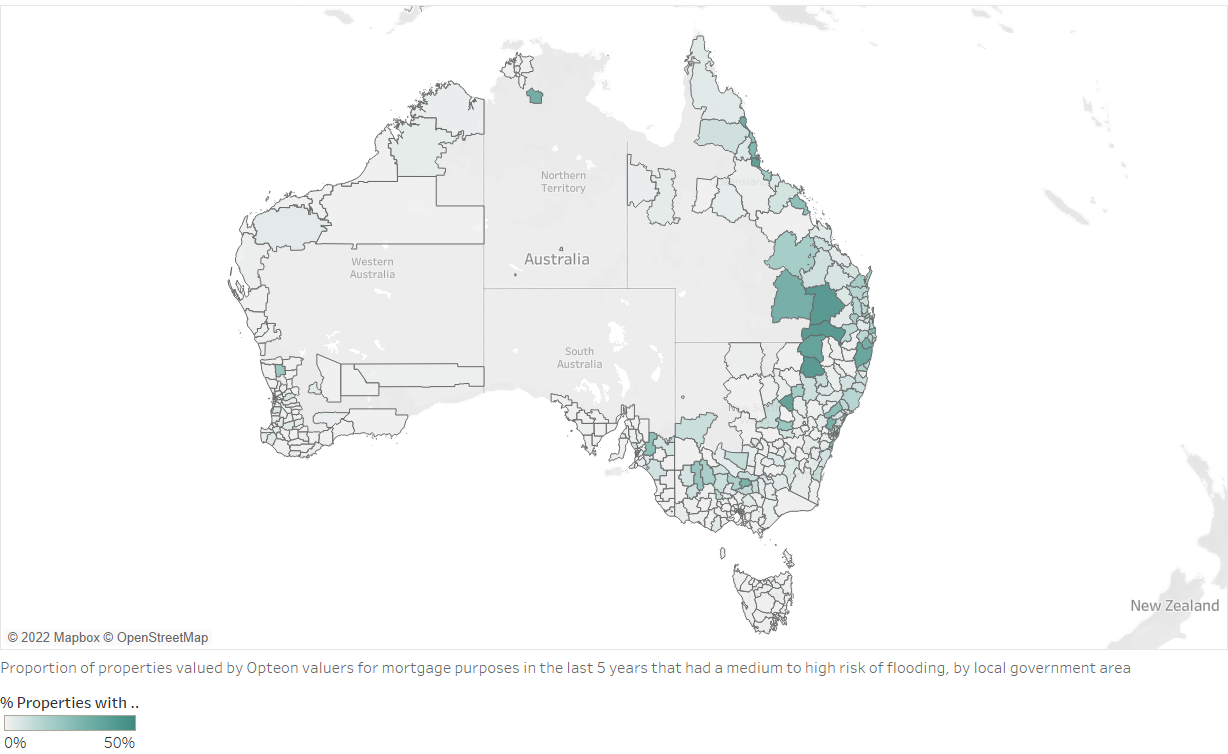

A further 6% of all properties we valued had a medium-high risk of flooding. As shown in the map below, there was again a risk cluster in southern Queensland and risks along much of the east coast. Medium-high risk LGAs were also seen in some parts of north-northwestern Victoria and eastern South Australia.

Properties with Medium to High Risk of Flooding by LGA - Map

Riskiest LGA'S

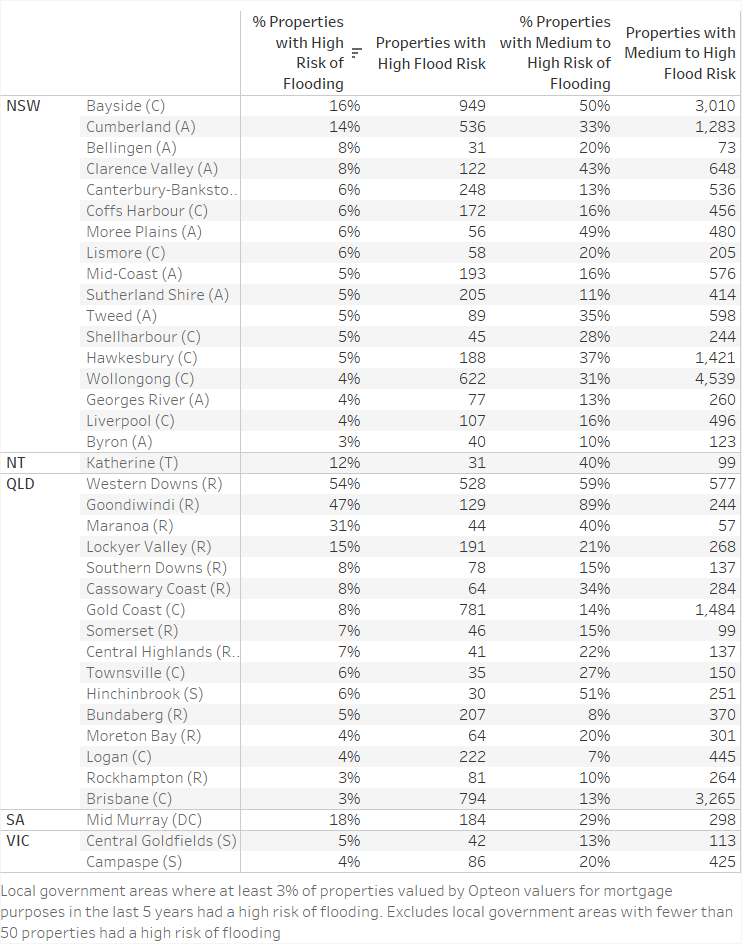

The following table contains the LGAs with the highest percentages of residential dwellings with high flood risk observed in the last five years by Opteon valuers. Areas with fewer than 50 properties recorded at high risk of flooding have been excluded.

Local Government Areas with Highest Flood Risk

Opteon is currently analysing how the regions with medium-high risk are performing compared to regions with lower percentage of flood risk.

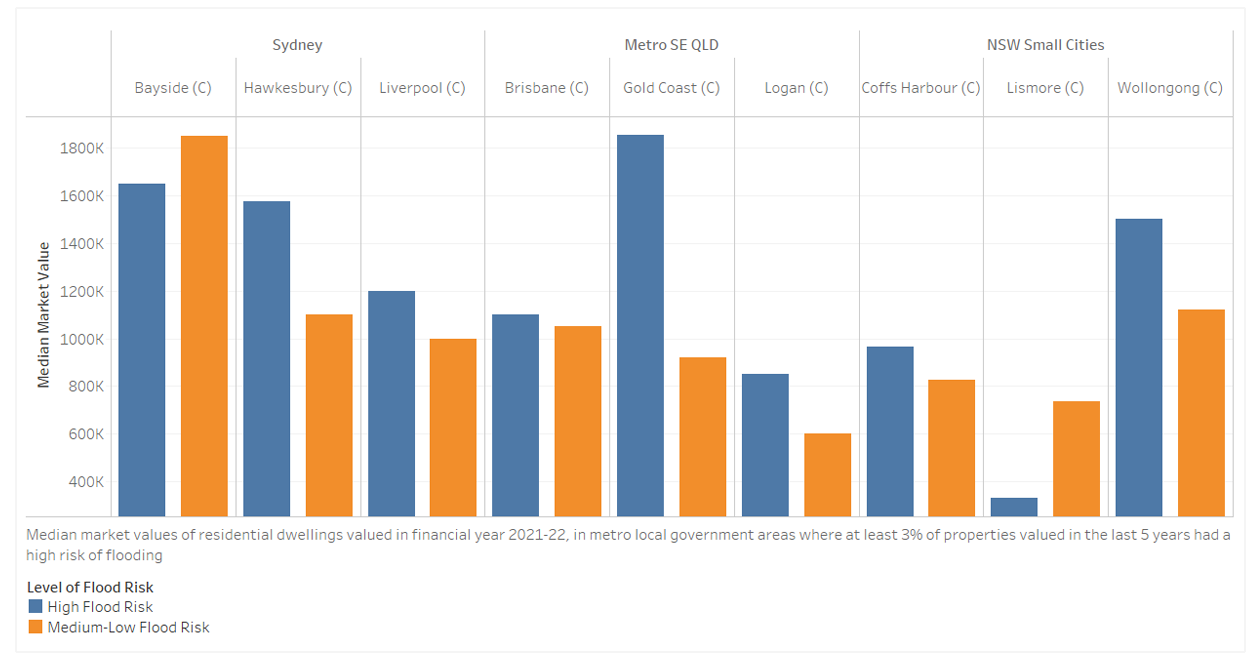

Historical flood risk effect on market value

As shown in the table below, in LGAs in metropolitan NSW and QLD with high proportions of properties at high risk of flooding, property values were not significantly affected by flood risk over a five-year window. In fact, properties with a high risk of flooding were often valued more highly than properties with a lower risk. As many of these are water-front properties or located close to waterways, the appeal of the location has often outweighed the flood risk for buyers.

Impact of Flood Risk on Property Value in NSW & Queensland Cities

However, as we move through the next year it will be interesting to see if these trends continue, especially in some of the regions shown in our graph where multiple significant and, at times, life-threatening floods have occurred in the last two years.

We will be monitoring these regions closely and reporting on the strength of these markets over the next 6-12 months.

Scott O'Dell

General Manager – Residential

DISCLAIMER

This material is produced by Opteon Property Group Pty Ltd. It is intended to provide general information in summary form on valuation related topics, current at the time of first publication. The contents do not constitute advice and should not be relied upon as such. Formal advice should be sought in particular matters. Opteon’s valuers are qualified, experienced and certified to provide market value valuations of your property. Opteon does not provide accounting, specialist tax, investment or financial advice.

Liability limited by a scheme approved under Professional Standards Legislation.

[1] https://www.afr.com/property/residential/house-prices-in-flood-hit-areas-in-for-a-long-recovery-20220706-p5azgc