What documentation do you need to support a construction loan?

Blog

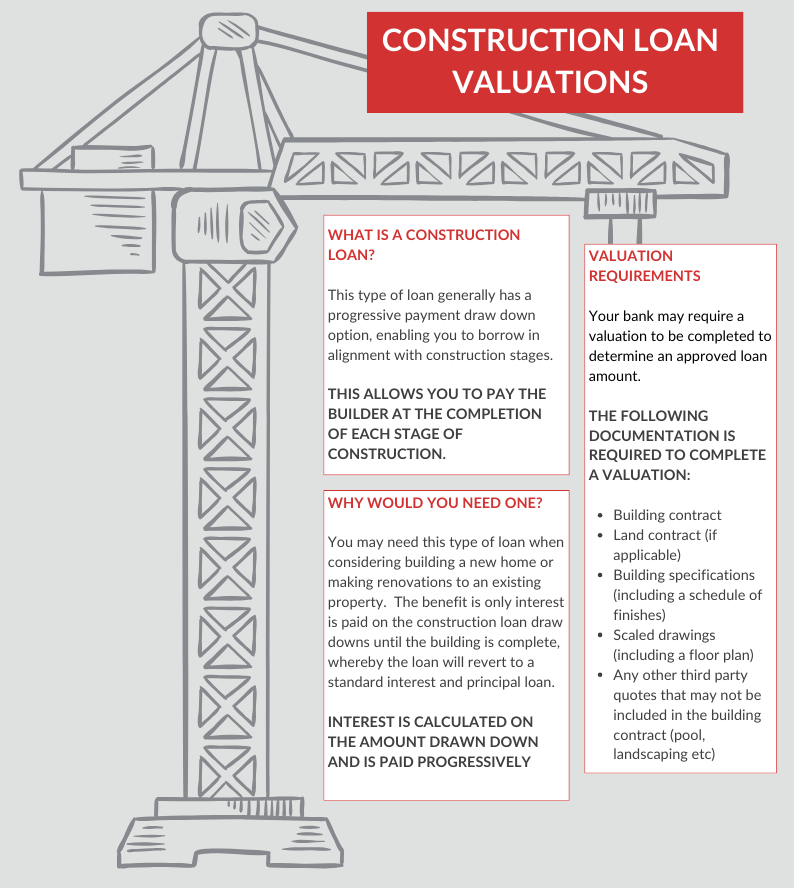

Are you looking to build a new home or considering renovations to an existing property?

You may need to apply for a construction loan. A construction loan with most lenders has a progressive payment draw down option, which enables you to borrow the loan in alignment with building/construction stages.

What documentation do you need to provide to support a construction loan?

In order to assist your financial institution in determining an approved loan amount, your bank may require a valuation to be completed on an "As If Complete" or "To Be Erected (TBE)" basis. That is a valuation based on the assumption of a completed product, in line with information and documentation provided.

In order to support this type of valuation the Valuer will require the following documentation:

- Building contract

- Land contract (if applicable)

- Building specifications including a schedule of finishes

- Scaled drawings including a floor plan

- Any other third party quoted that may not be included in the building contract (i.e. pool quote, landscaping etc.)

These documents enable a clear and unbiased picture to be provided to the bank as to what the finished product will be, in the form of a valuation. In addition to this, they will also require a market valuation based on current market conditions, which is in line with recent comparable sales evidence.

The "As If Complete" or "To Be Erected" valuation can only be based on documentation provided, so it's important to provide as much information as possible including quotations for additional work over and above the building contract. This may include items such as landscaping, driveways, fencing, floor coverings, window coverings etc.

This information is based on the most common construction loan valuation scenarios we come across. There may be additional documentation requirements, dependent on your nominated financial institution. Reach out today if you have questions about obtaining construction loan valuations.

.png)