Shrinking Risk Margins Challenge sub-$50m Commercial Assets

Newsletter

Ross Turner, National Director - Commercial Agri Advisory

A risk margin is the percentage gap between property yields and bond yields. Essentially, the risk margin tracks the size of the financial benefit of a ‘growth’ investment in property compared to a ‘defensive’ or ‘risk-free’ investment in government bonds.

In the last three years, and particularly since the start of 2021, we have seen a decrease in the risk margin of sub-$50m commercial assets contract. This sends a clear signal of risk to the market.

A challenging set of market conditions

There is currently a challenging combination of market factors affecting commercial property in the sub-$50m category of assets.

Commercial property as an investment class carries additional risk to Australian government bonds, with bond returns considered a risk-free investment base due to its sovereign backing.

Commercial property prices have been rising over the last 2 years faster than net income growth, resulting in contracting property yields. As the growth in value has not been driven by income growth, headwinds are emerging, due to rising interest rates, and trimmed mean inflation at its highest rate since 2013[1]. Added to those factors is the rising value of government bond rates, increasing the attractiveness of this investment class.

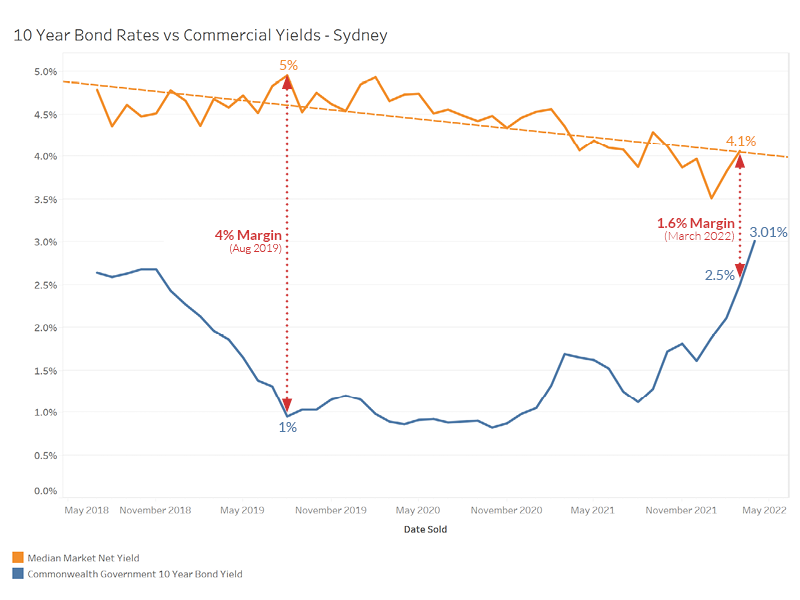

While yields on 10-year Commonwealth Government bonds fell to a 2 year low 0.60% in March 2020, they have increased since then to average 3.01% during April 2022[2] and further to a high of 3.57% on 10 May 2022, for a 3.44% 1-17 May average. [3]

These market factors have seen the risk margin between bonds and commercial property drop since 2019, particularly impacting key markets like Sydney. This is resulting in commercial property yield margins struggling to stay above the government bond rate. For example, as shown in the graph below, net yields on properties within the sub $50 million space in Sydney have been falling, which means that the risk margin is expected to drop below 1% in May. The orange dotted line is based on Opteon's own sales data.

The contraction of the risk margins between bonds and commercial yields of sub-$50m commercial assets raises some key issues for the market:

- Will investors shift to bonds as the general economic climate faces potential head winds?

- Are commercial property yields going to soften to reflect an appropriate risk margin between bonds and commercial property and will values fall as a result?

- Will increases in rents mitigate any softening in values?

Key market exposures

Leases that are structured and oriented to take advantage of rising inflation will perform more strongly at this point of the cycle. Importantly, by virtue of the low inflationary environment over the past ~9 years we have witnessed a shift away from inflation or CPI linked annual reviews toward fixed percentage reviews (say 2.5-3.5%). This may result in annual rental increases not keeping up with inflation during the remainder of these lease terms.

Rises in bond yields

Sub-$50m commercial assets are exposed to rises in government bond yields because of the growing attractiveness of bonds as an investment in comparison to commercial property. Values of commercial property may stall or drop, due to either pressures in net income decreasing (either due to flat growth or increased outgoings in gross lease scenarios), or due to softening of market yields.

Rental Growth

Whilst inflation pressures should be passed through in rental increases, not all markets are created equal, with some lease profiles subject to lease arrangements that may not accommodate immediate increases.

Gross lease structures may not allow for increases in statutory and operational outgoings expenses (leading to a net income squeeze).

Additionally, the ongoing viability of some tenants’ businesses, which may have been propped up by COVID-19 government stimulus measures is still to be proven.

Leases that are structured and oriented to take advantage of rising inflation will perform more strongly at this point of the cycle.

Net Income squeeze

In the context of rising interest rates, flattening rents and increasing outgoings, net income can be squeezed when gross lease arrangements are not being reviewed within a close enough period to accommodate adjustments for inflation of outgoings.

This is often an issue with assets with a high underlying land value. For example, securely leased, underdeveloped retail premises in urban growth areas/ development corridors where there is no ability to break or review the lease within a reasonable period of time may experience significant net income downward pressures, which could lead to a negative cash flow situation.

Outgoings

Outgoings are increasing due to rises in land tax and council rates, due to being linked to rising unimproved/ rateble property values that have risen steadily over the past couple of years. Other outgoings have also been affected by rising inflation and ongoing global supply chain issues. Where outgoings grow at a higher rate than rents in a gross lease arrangement, yields are put under further pressure. This is a common issue for commercial properties in the sub $10m category, which typically include gross lease arrangements rather than the net lease agreements that are more commonly found in corporate lease structures.

Outlook

As the market continues to evolve, holders of sub-$50m commercial assets will be watching the growth potential of their investments through this part of the cycle.

DISCLAIMER

This material is produced by Opteon Property Group Pty Ltd. It is intended to provide general information in summary form on valuation related topics, current at the time of first publication. The contents do not constitute advice and should not be relied upon as such. Formal advice should be sought in particular matters. Opteon’s valuers are qualified, experienced and certified to provide market value valuations of your property. Opteon does not provide accounting, specialist tax, investment or financial advice.

Liability limited by a scheme approved under Professional Standards Legislation.

[1] https://www.rba.gov.au/publications/smp/2022/feb/inflation.html

[2] https://www.rba.gov.au/statistics/tables/xls/f02hist.xls