WA’s Population Boom and What It Means for Retail Property

Blog

Author: James Stuttard, State Director WA

James has worked in the property industry since 2015, beginning his career as a Trainee Valuer with Opteon. He became a Certified Property Valuer in 2018 and is now the State Director of Core Commercial WA. James specialises in retail, office and industrial assets, with broad experience across the commercial property sector.

Western Australia is in the midst of a demographic surge that’s reshaping the retail property sector. Over the past decade, Australia’s population has grown by around 20% (from 22.3 million in 2011 to 26.7 million in 20241), but WA has consistently outpaced the national average2.

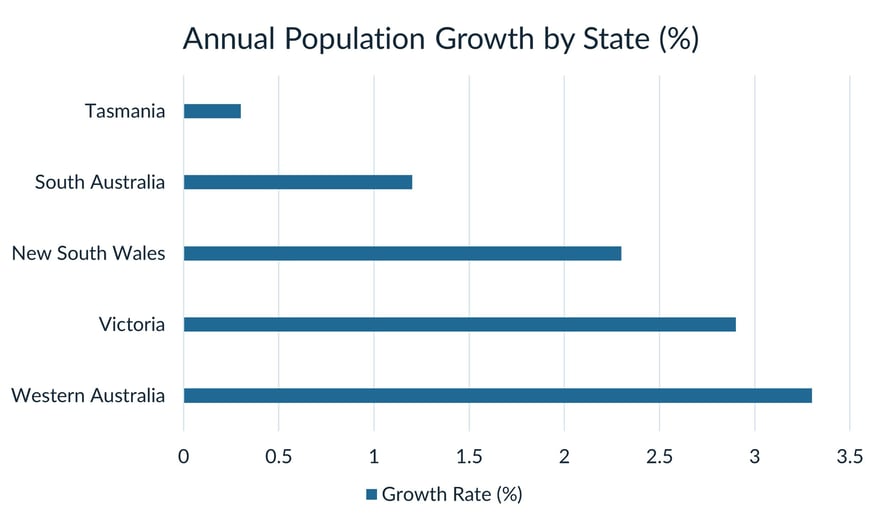

In 2023, WA recorded 3.3% annual growth, the fastest of any state or territory, compared with 2.5% nationally3.

Much of this growth is driven by overseas migration and strong interstate inflows, particularly into Perth.

The Federal Government projects Australia’s population will reach 30.9 million by 2034, with WA expected to capture a significant share thanks to mining, energy, and lifestyle-driven migration4.

For retail property owners and investors, this demographic momentum translates directly into rising demand for shopping centres, large-format retail, and suburban neighbourhood hubs.

Why Population Growth Drives Retail Demand

Population growth isn’t just a headline figure; it underpins the very fabric of retail property performance. More residents mean:

-

Increased consumer spending power – every new household brings demand for groceries, clothing, services, and entertainment.

-

Demand for new retail hubs – suburbs expanding on Perth’s fringe require new shopping centres and local strip retail.

-

Resilient rental income – stronger foot traffic and sales can underpin tenant viability and reduce vacancy risks.

Exacerbating this surge in demand is a limited pipeline of retail construction in the near term. While development appetite exists, high construction and financing costs continue to delay major redevelopment.

Instead, owners are focused on optimising existing assets.

Limited new supply, combined with WA’s strong population growth, has resulted in low retail floorspace per capita driving up visitation, sales (MAT), and rental growth.

Our commercial property valuation team are seeing this play out in valuations across metropolitan Perth and regional growth centres. Properties positioned near high-growth population corridors are achieving stronger rental forecasts and sharper capitalisation rates than comparable assets in low-growth regions.

Perth and Regional WA: Where the Growth Is Happening

Perth Metro

Perth’s north-west and south-east corridors are experiencing some of the fastest population expansion in Australia. Suburbs like Ellenbrook, Alkimos, Baldivis and Byford have seen rapid housing development, with corresponding spikes in demand for local retail centres.

Regional WA

It’s not just Perth. Mining and resources activity continues to attract workers to Pilbara hubs like Karratha and Port Hedland, supporting demand for supermarkets, bulky goods retail, and essential services. Towns like Bunbury and Busselton are also growing quickly, driven by lifestyle migration.

Comparison to Other States

While WA posted 3.3% annual growth, other states lagged behind3:

This reinforces WA’s position as the national leader in demographic growth.

The Impact on Retail Valuations in WA

For specialist real estate investors, population growth directly shapes valuation outcomes.

Key factors include:

-

Higher rental demand – tenants are willing to pay more for high-traffic locations.

-

Lower vacancy risk – a growing population supports a diversified tenant mix with vacancy remaining low across convenience-based centres, with tenant demand stable and incentives easing. Asset values are supported by income growth and resilient tenant performance

-

Cap rate compression – demand for retail assets in high-growth corridors pushes yields down and valuations up.

-

REITs, syndicators and private investors, including high-net-worth individuals and family offices, remain active in acquiring neighbourhood centres underpinned by strong land value and mixed-use potential

From a retail valuation WA perspective, we are observing that shopping centres in Perth’s growth suburbs command premiums relative to those in stagnant catchments. Investors are also displaying a continued strong appetite for neighbourhood shopping centres anchored by supermarkets — assets directly tied to population-driven demand.

Demographic Tailwinds vs. Economic Headwinds

Of course, population growth doesn’t occur in a vacuum. Retail property is still sensitive to:

-

Interest rates – higher borrowing costs can soften yields.

-

Consumer confidence – household spending patterns shift with inflation and wage growth.

-

E-commerce – population growth supports omni-channel retail, but bricks-and-mortar assets must adapt.

However, WA’s strong fundamentals mean that even amid broader economic uncertainty, population-driven demand for retail space remains resilient.

What Investors Should Be Watching

-

Catchment Analysis – retail properties near planned housing estates or infrastructure projects in WA are poised for strong demand.

-

Tenant Mix – growth suburbs support essential-service tenants (supermarkets, pharmacies, medical centres), which perform well regardless of economic cycles.

-

Regional Resilience – towns tied to mining and energy exports may see fluctuating demand, but core retail remains essential.

A commercial property valuer in WA can provide the localised insights necessary to distinguish between assets with sustainable long-term growth and those exposed to short-lived booms.

WA’s Population Growth is Reshaping Retail Property

Western Australia’s record-setting population growth is not just a demographic statistic; it’s a direct driver of retail property performance. For landlords, developers, and investors, this growth offers opportunities to capture rising demand for retail centres in both Perth’s growth corridors and regional towns.

As specialist real estate experts in WA, our advice is clear: population growth should be a core lens through which you evaluate retail property opportunities. Whether acquiring, holding, or divesting, understanding how demographics intersect with property fundamentals will help you unlock long-term value.

Need a valuation?

Get in touch with our experienced residential team at Opteon for an accurate, independent assessment tailored to your needs.

James Stuttard

State Director WA

james.stuttard@opteonsolutions.com

Subscribe to Receive the Latest Property Insights!

References

- Australian Bureau of Statistics. National, state and territory population, Dec 2023. https://www.abs.gov.au/statistics/people/population/national-state-and-territory-population/dec-2023

- ABC News. WA population surpasses 3 million. https://www.abc.net.au/news/2025-06-19/wa-population-hits-three-million-abs-data-reveals/105436770

- 7News. WA records highest population growth. https://7news.com.au/news/wa-records-highest-population-growth-as-australia-hits-27-million-milestone--c-16119740

- WA Government. WA Tomorrow 12 – Population Forecasts. https://www.wa.gov.au/organisation/department-of-planning-lands-and-heritage/western-australia-tomorrow-12-population-forecasts

DISCLAIMER

This article is produced by Opteon Property Group Pty Ltd. It is intended to provide general information in summary form on valuation related topics, current at the time of first publication. The contents do not constitute advice and should not be relied upon as such. Formal advice should be sought in particular matters. Opteon’s valuers are qualified, experienced and certified to provide market value valuations of your property. Opteon does not provide accounting, specialist tax or financial advice.

Liability limited by a scheme approved under Professional Standards

.png)